Goalsbased investing empowers intermediaries, institutions and individuals alike to focus on what really matters achieving goals And when you marry those goals with our global economic perspective, it's a powerful framework that Improves on traditional portfolio construction, as it places a larger emphasis on alignment with investor goalsGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsThe goalbased investing framework mitigates behavioural biases while producing an optimal asset allocation that funds lifetime aspirations The probability of reaching or failing to reach an investment target is integral and should be considered as the modern standard for risk measurement in behavioural portfolios

Has Financial Attitude Impacted The Trading Activity Of Retail Investors During The Covid 19 Pandemic Sciencedirect

Goal-based investing theory and practice

Goal-based investing theory and practice- What Is GoalsBased Investing?Goalbased Investing Theory And Practice Romain Deguest Kindle Edition 1 offer from $1853 #39 How I Made $2,000,000 in the Stock Market (Illustrated) Best Stock Market Book with Practical Guide for Every Investor to Understand the Market Nicolas Darvas 50 out

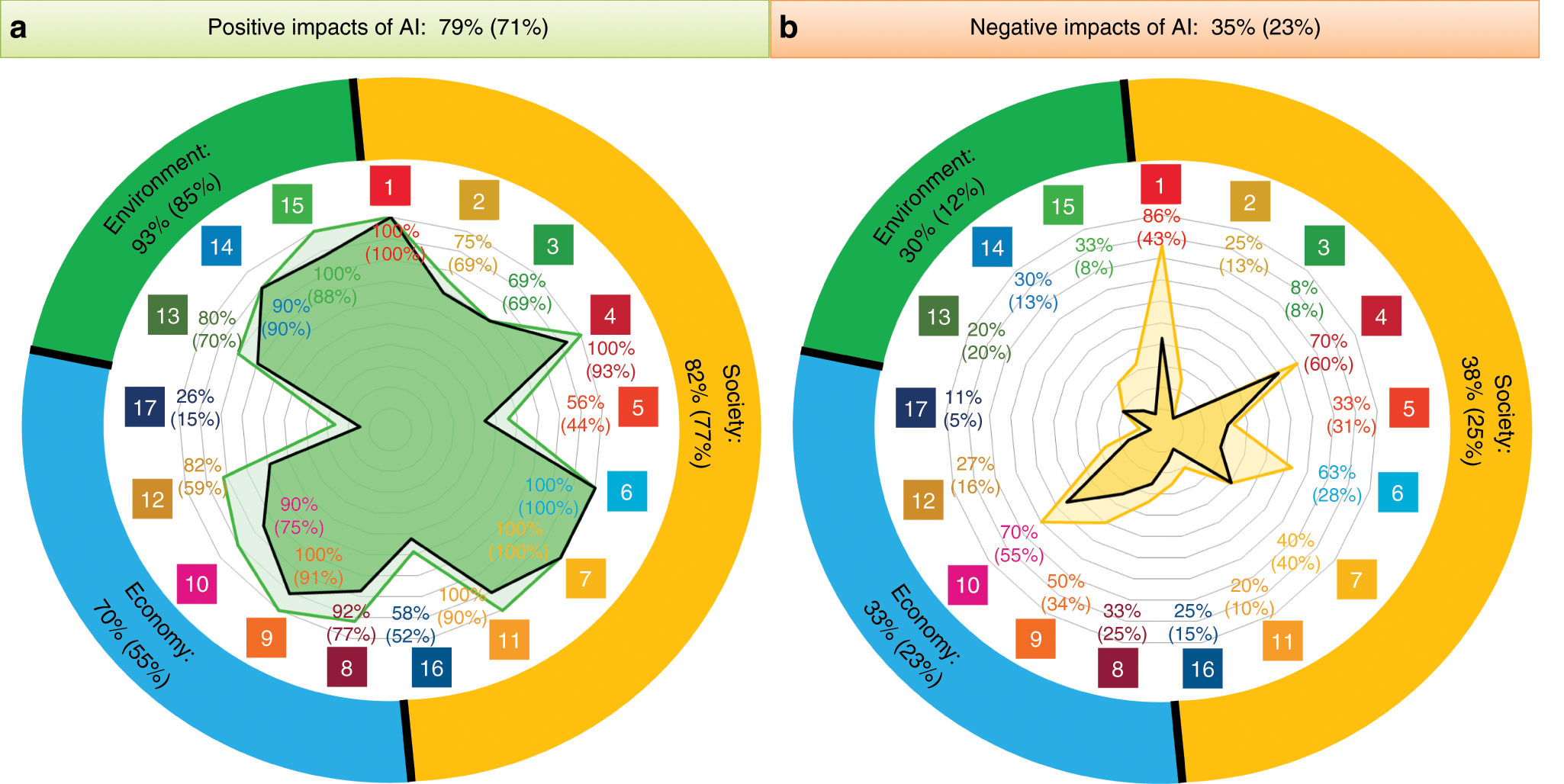

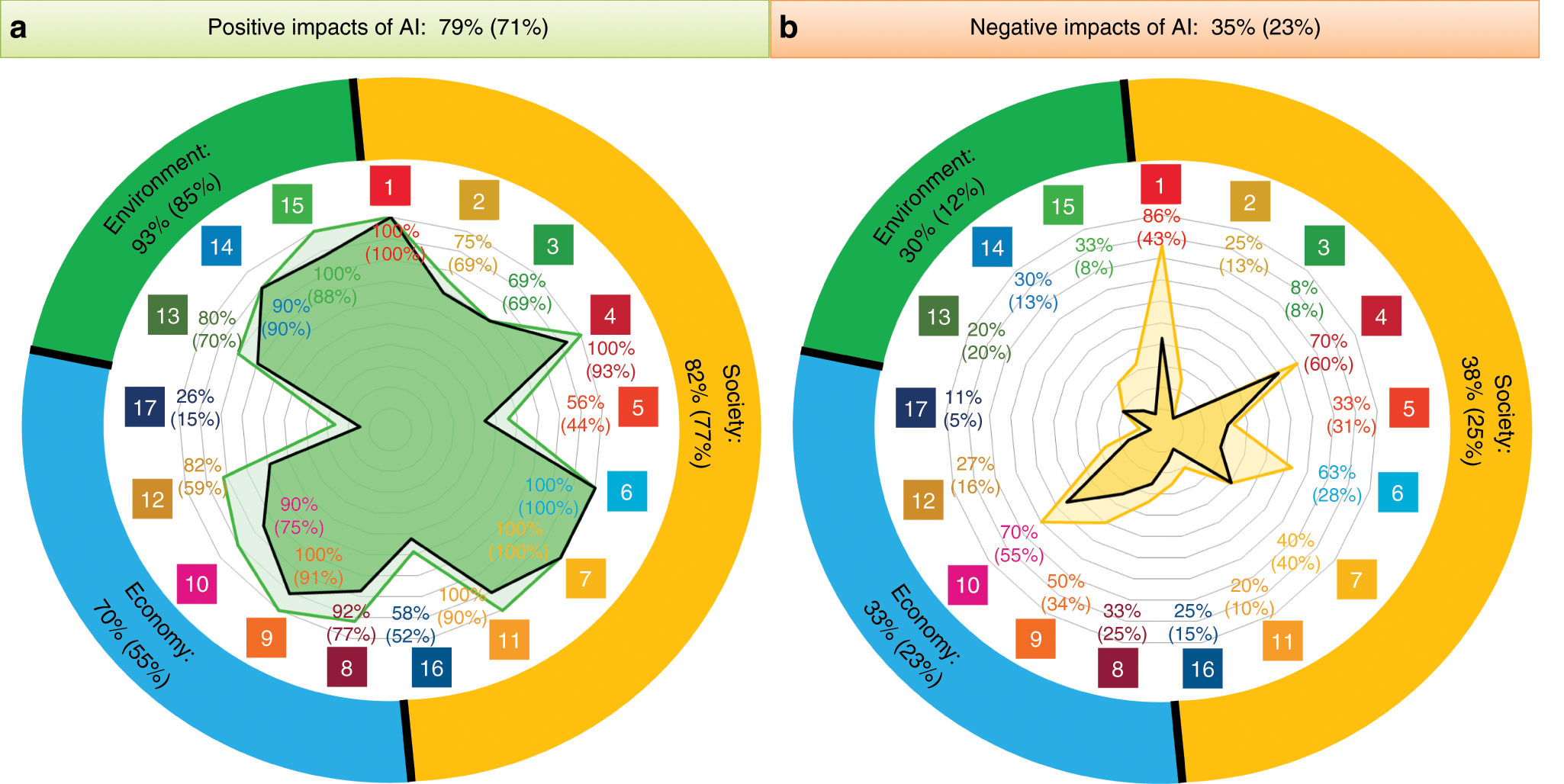

The Role Of Artificial Intelligence In Achieving The Sustainable Development Goals Nature Communications

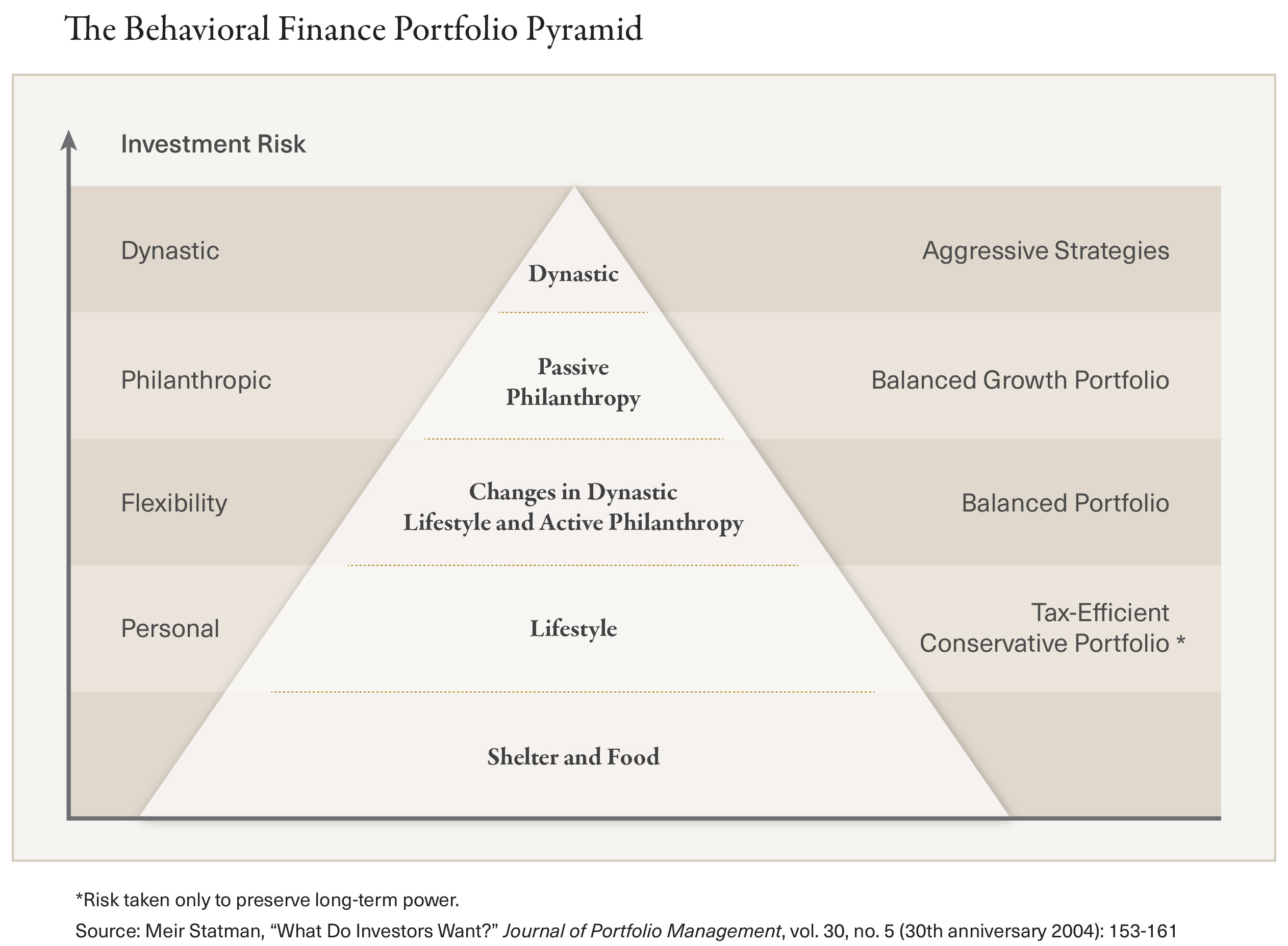

Goalsbased asset allocation seeks to align our total portfolio, including financial and nonfinancial assets, with our personal goals and our human way of thinking about risk The framework combines attributes of modern portfolio theory and behavioral finance in a commonsense manner, and is extremely flexible at the individual levelGame Theory Micro, Macro, and International Economics, Workbook Real Estate Finance and Investments Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can beGoalbased investing (GBI) implements dedicated investment solutions to generate the highest possible probability of achieving investors' goals, with a reasonably low expected shortfall in case of adverse market conditions

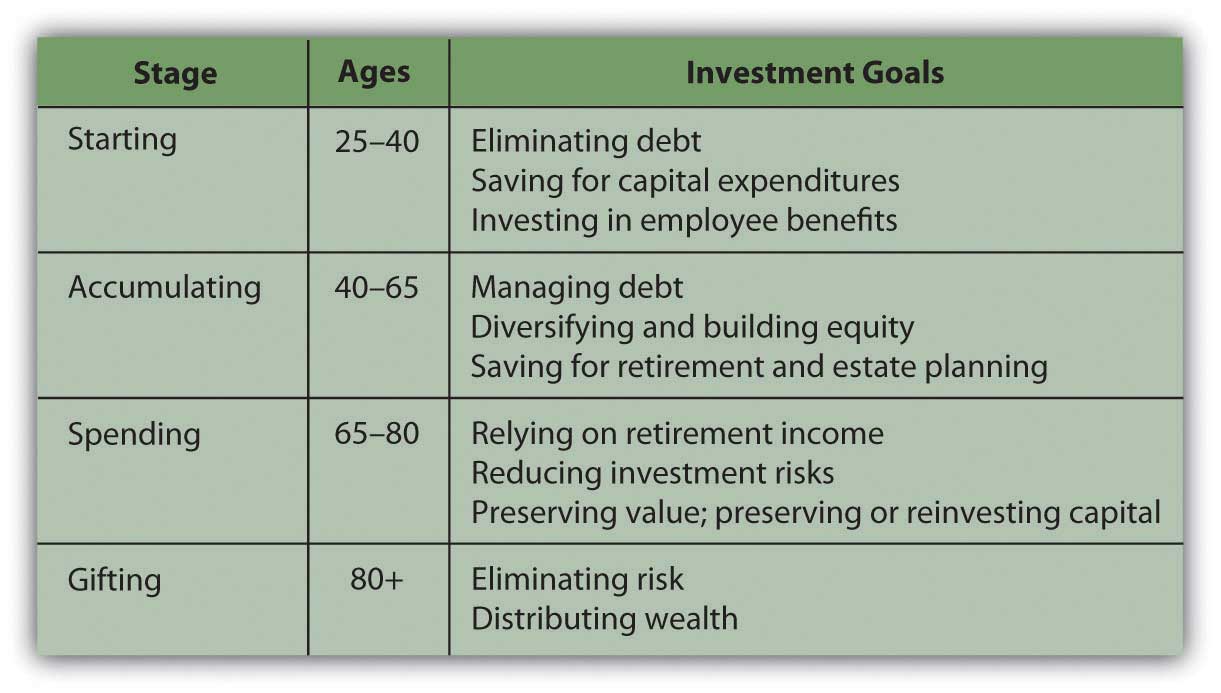

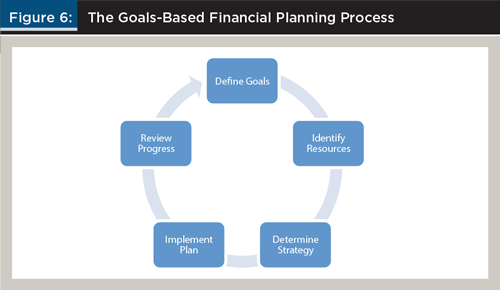

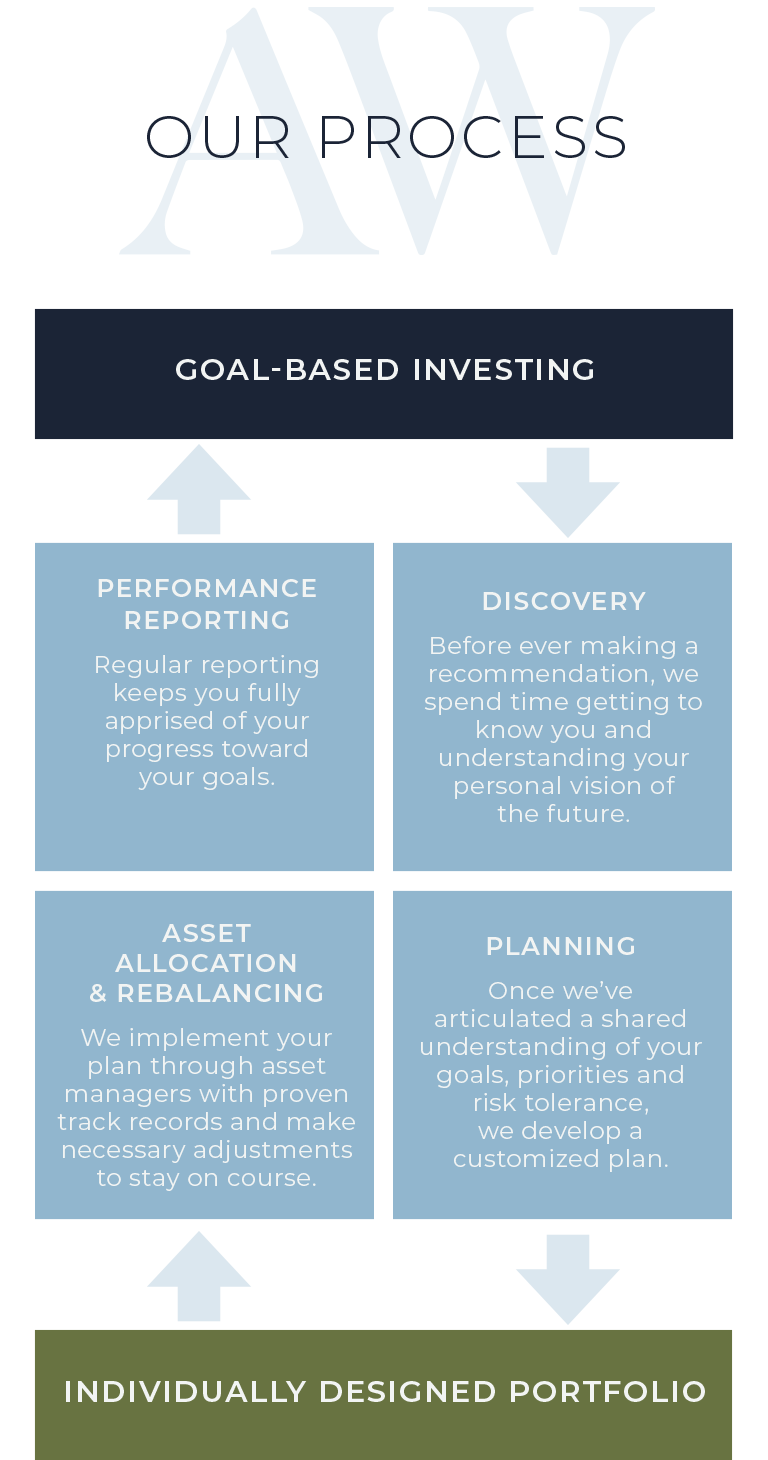

By Becca Long on When it comes to reaching your financial goals, there are many roads you could take—and they don't necessarily all lead to the same place Goalbased Investing Theory And Practice Author Romain Deguest Publisher World Scientific ISBN Category Business & Economics Page 324 View 219 DOWNLOAD NOW » Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail The goalbased investing planning process comprises 5 phases #1 Define possible financial objectives #2 Identify current and future available resources #3 Determine the appropriate strategy for the distribution of capital between savings and investments, in accordance with their characteristics and personal conditions, and aimed at achieving objectives #4 Implement the plan

Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assets5 "GoalsBased Wealth Management in Practice", CFA Institute Conference Proceedings Quarterly, March 12, Vol 29, No 1, Jean LP Brunel, CFA 6 "GoalsBased Investing Integrating Traditional and Behavioral Finance", Daniel Nevins, Spring 04, Journal of Wealth Management SEI GOALS BASED INVESTINGindd 2 1312 Yet the challenge of goalsbased investing is that it presumes clients know what their goals are, and can effectively articulate them which in practice isn't always the case In part because the compounding math of wealth accumulation itself isn't natural for most, and it's difficult to set goals if you don't even know what the

Shareholders Are Getting Serious About Sustainability

Higher Cost Of Finance Exacerbates A Climate Investment Trap In Developing Economies Nature Communications

Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assets GoalsBased Investing There's a difference between monitoring an investment and checking its performance on a daily basis Rather than being concerned about shortterm volatility in the market, consider the future purpose or goal of what you want your money to pay for This is the fundamental idea behind goalsbased investingGoalsbased investing empowers intermediaries, institutions and individuals alike to focus on what really matters achieving goals And when you marry those goals with our global economic perspective, it's a powerful framework that Incorporates cuttingedge insights from behavioural finance Helps keep investors focused on the right things

3

Paul Schweigl Columbia University In The City Of New York United States Linkedin

Advances in Retirement Investing; Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets andLionel Martellini's 1 research works with 1,621 citations and 10,213 reads, including Goalbased Investing Theory and Practice

2

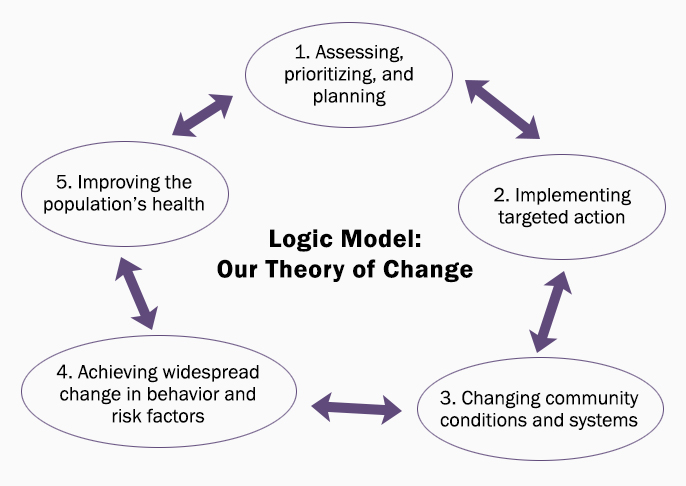

Chapter 1 Our Model For Community Change And Improvement Section 3 Our Model Of Practice Building Capacity For Community And System Change Main Section Community Tool Box

Goalsbased investment theory not only acknowledges these goals, it provides budgets and portfolios for them In the end, goalsbased investing is simply about using financial markets to achieve your goals under realworld constraints But that can only happen by first understanding and modeling the objectives you're actually trying to achieve First, goalsbased investing can create a lasting value proposition — if both financial firms and clients have the courage to break out of the established, largely faulty models Asset owners with limited institutional constraints — such as family offices and ultrahighnetworth individuals — are very well placed to accomplish this Goalsbased investment theory not only acknowledges these goals, it provides budgets and portfolios for them In the end, goalsbased investing is simply about using financial markets to achieve your goals under realworld constraints But that can only happen by first understanding and modeling the objectives you're actually trying to achieve

Climate Relevant Behavioral Spillover And The Potential Contribution Of Social Practice Theory Nash 17 Wires Climate Change Wiley Online Library

Has Financial Attitude Impacted The Trading Activity Of Retail Investors During The Covid 19 Pandemic Sciencedirect

Introducing a Comprehensive Allocation Framework for GoalsBased Wealth Management Romain Deguest, Lionel Martellini, Vincent Milhau, Anil Suri, Hungjen Wang This publication introduces a new conceptual framework to better achieve individual investors' goals1032 GoalBased Investing Theory 9in x 6in b48ch01 page 4 4 GoalBased Investing Theory and Practice Huang (19) to the presence of nonportfolio income It is wellknown that the existence of a stateprice deflator, or equivalently of anequivalent martingale measure,isnotsufficienttoavoid arbitrage opportunitiesAbstract Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging

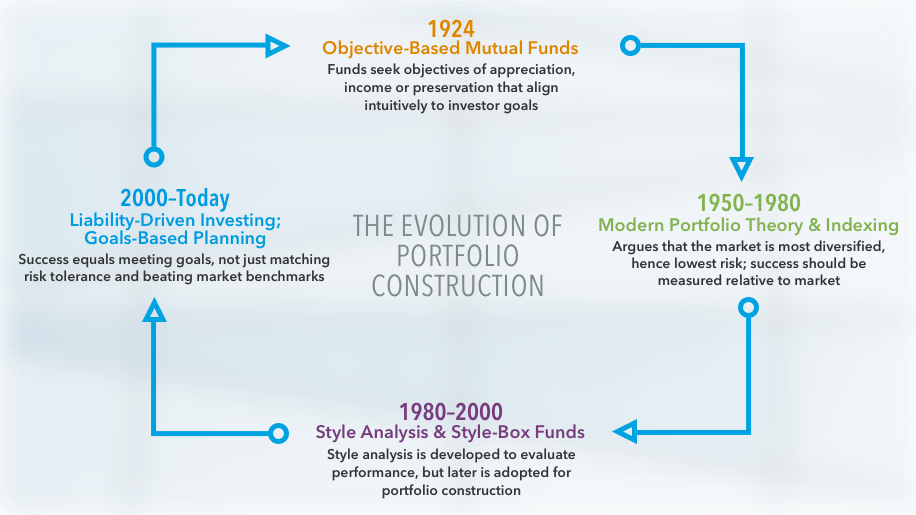

Back To The Future The Return Of Objective Based Investing Capital Group

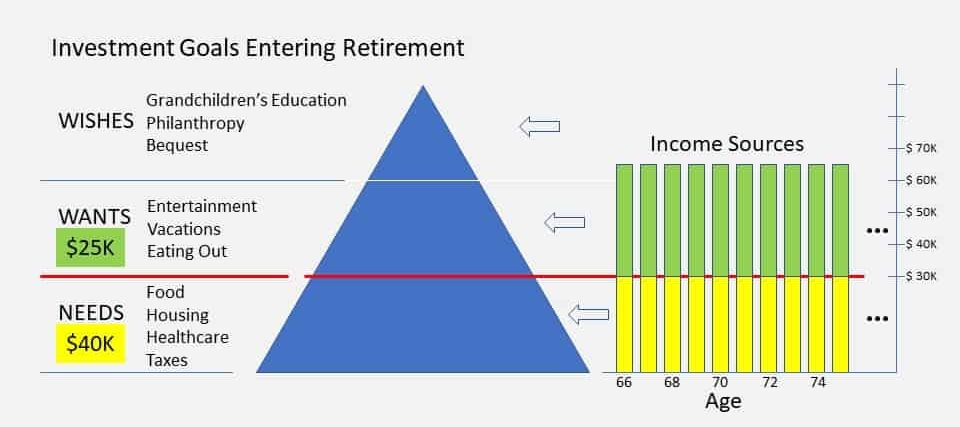

Goal Based Investment Planning Retirement Planning Example And Video

Goalbased Investing Theory And Practice mfl Få Goalbased Investing Theory And Practice af Deguest Romain Deguest som ebog på engelsk Bøger rummer alle sider af livet Læs Lyt Lev blandt millioner af bøger på SaxocomKeywords Goalsbased investing, dynamic programming, retirement planning JEL Codes G11, G40, G50 ∗We thank the editor and two referees for many constructive comments We are grateful for discussions and contributions from many of the

/top-investing-strategies-2466844-FINAL-33a6c4fecfc14360837d5daa36c079a7.png)

Best Investment Strategies

What Is Goal Based Financial Planning Peak Financial Services

GoalsBased Investing There's a difference between monitoring an investment and checking its performance on a daily basis Rather than being concerned about shortterm volatility in the market, consider the future purpose or goal of what you want your money to pay for Goalsbased investing may seem like an obvious concept, but it represents a departure from the typical risktolerance framework, which profiles clients based on whether they have a conservative Goalsbased portfolio theory is also concerned with how you allocate your wealth across your goals, which I have not covered in this post, but I will cover that in a later discussion Keywords goalsbased investing, goal based investing, investing, portfolio theory

The Role Of Artificial Intelligence In Achieving The Sustainable Development Goals Nature Communications

You Can Be Rich With Goal Based Investing A Book By Subra Pattu

Goalsbased investing is more than just "investing in a way to achieve goals" Of course, that is the essence of the idea, but how you go about doing that is where the key differences lie To properly understand how it is different, you really need to understand a little about investment theory inGoalsBased Investing or GoalDriven Investing is the use of financial markets to fund goals within a specified period of time Traditional portfolio construction balances expected portfolio variance with return and uses a risk aversion metric to select the optimal mix of investments By contrast, GBI optimizes an investment mix to minimize the probability of failing to achieve a minimum wealth Synopsis Maximum Wealth Minimum Taxes written by T Ross Nichol, published by Anonim which was released on 22 October 21 Download Maximum Wealth Minimum Taxes Books now!Available in PDF, EPUB, Mobi Format

Amazon Com Goals Based Investing A Visionary Framework For Wealth Management Davidow Tony Books

2

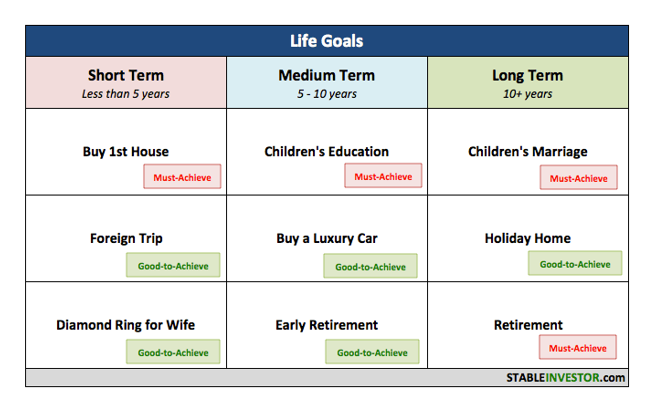

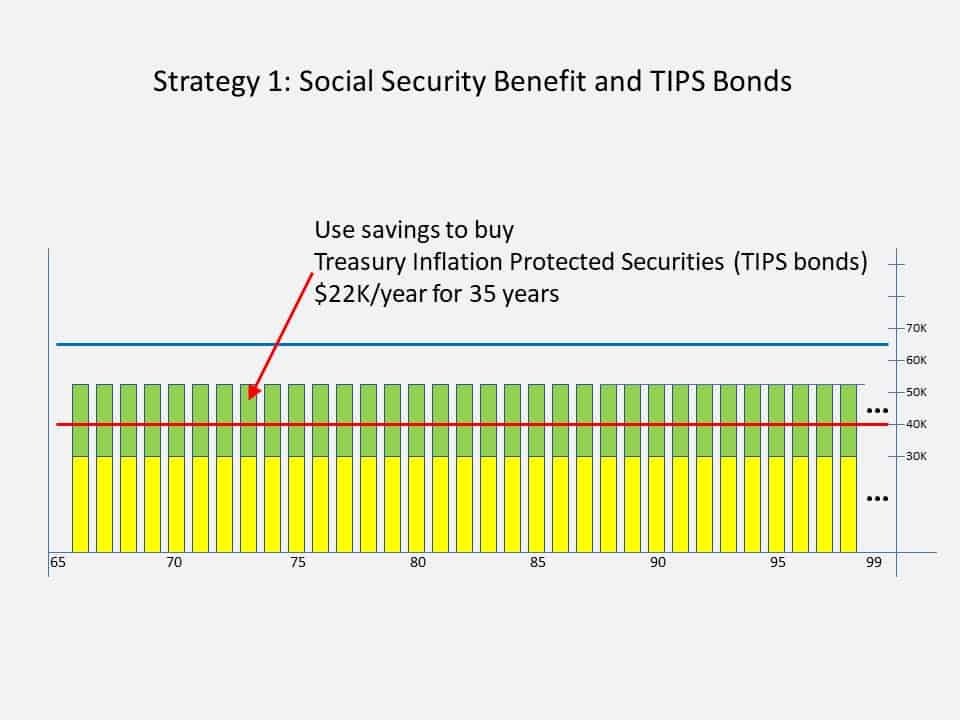

In the world of financial advice, we are seeing a welcome trend toward goalsbased investing This trend puts a greater focus on the goals that investors want to achieve with their savings —such as retirement security, paying for college or purchasing a house — and uses these goals to drive investment strategy and monitor progress Grounded in the principles of asset pricing and portfolio optimisation, the goalbased investing approach leads to the design of investment solutions that truly respond to investors' problems, which can most often be summarized as follows secure essential goals with the highest confidence level and maximize the chances to reach aspirational goalsA series of case studiesThe basis for the goalsbased wealth management approach developed in this paper In its simplest form, goalsbased wealth management can be defined as a process that focuses on helping investors realize their goals, both shortterm and longterm, through a portfolio management method primarily focused on reaching welldefined financial goals

:max_bytes(150000):strip_icc()/wealthfront-vs-td-ameritrade-essential-portfolios-072e85eb93f449cab08317a9625d8776.jpg)

Goal Based Investing Definition

Ways To Implement Restorative Practices In The Classroom Opinion

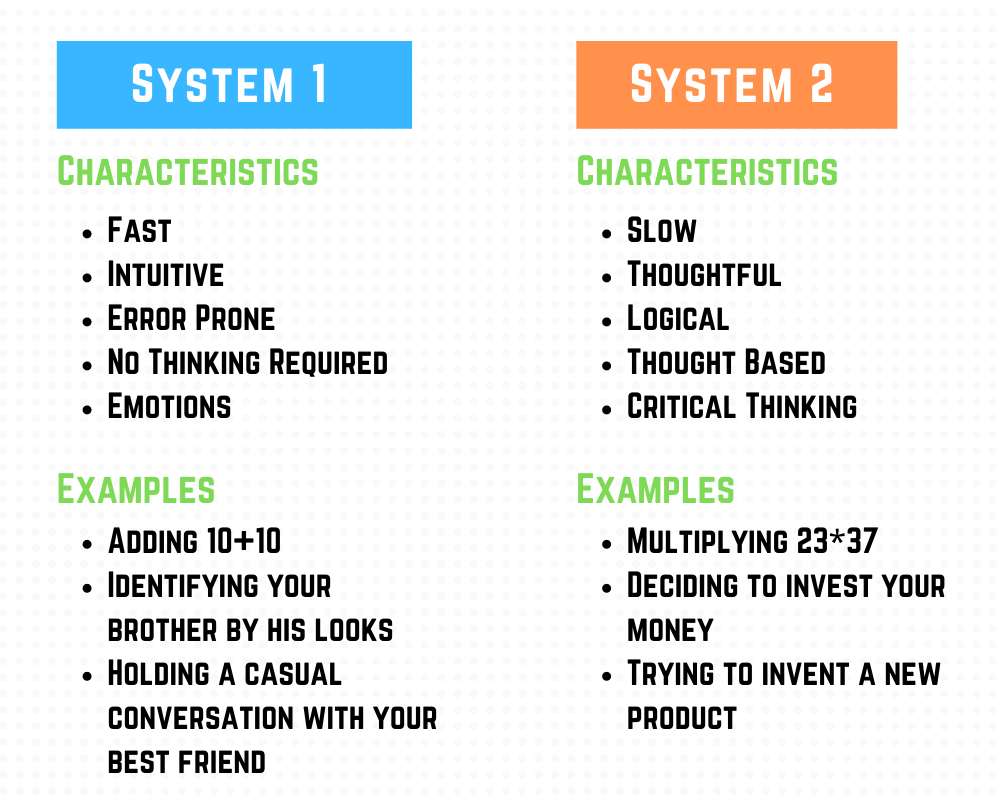

This work examines the Constant Proportion Portfolio Insurance (CPPI) investment strategy under the assumption of a cumulative prospect theory (CPT) investor It is found that such an investor who alters their reference point, dependent on the underlying risky asset, prefers strategies that extend the functionality of the CPP!Moreover, in a goalbased investing framework, an approach for elicitation of risks related to the goals of a family was developed by Brunel 15 that integrates Markowitz 56 with mentalGoalbased Investing and Probabilistic Scenario Optimisation Australia Digital Marketing Professionals Sydney, Melbourne, Brisbane, Perth, Adelaide,

A Framework For Goals Based Investing Boston Private

Modern Investment Management An Equilibrium Approach Economics Books Amazon Com

Goalbased Planning vs Cash Flow Planning Which One Will Help You Go Where You Want?Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assets GoalsBased Investing There's a difference between monitoring an investment and checking its performance on a daily basis Rather than being concerned about shortterm volatility in the market, consider the future purpose or goal of what you want your money to pay for This is the fundamental idea behind goalsbased investing

Goal Based Investing Through Mutual Funds Youtube

Investor Behavior

Köp böcker av Martellini Lionel Martellini Advanced Bond Portfolio Management;Environmental, Social, and Governance (ESG) Investing A Balanced Analysis of the Theory and Practice of a Sustainable Portfolio presents a balanced, thorough analysis of ESG factors as they are incorporated into the investment process An estimated 25% of all new investments are in ESG funds, with a global total of $23 trillion and the USDownload Free Goals Based Wealth Management An Integrated And Practical Approach To Changing The Structure Of Wealth Advisory Practices Wiley Financethat help readers secure a deep understanding of the key ideas that make goalsbased wealth management work The goalsbased wealth management approach was pioneered in 02, but has seen a slow evolution and

Nudge Marketing From Theory To Practice Cxl

Idea Model From Theory To Practice Integrating Information Literacy In Academic Courses Sciencedirect

GoalsBased Investing There's a difference between monitoring an investment and checking its performance on a daily basis Rather than being concerned about shortterm volatility in the market, consider the future purpose or goal of what you want your money to pay for This is the fundamental idea behind goalsbased investing

Why Practicing Goal Based Investing Is Essential For Small Investors

High Quality Health Systems In The Sustainable Development Goals Era Time For A Revolution The Lancet Global Health

Goals Based Investing Or Modern Portfolio Theory Diligencevault

Goals Based Investing From Theory To Practice

Unpacking The Impact In Impact Investing

Goal Based Investing How Does It Work Everyfin Newsletter

2

Goal Attainment Scaling With Older People In General Practice A Feasibility Study Sciencedirect

A Framework For Goals Based Investing Boston Private

/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

Investment Pyramid

Why Practicing Goal Based Investing Is Essential For Small Investors

Goal Based Investing Mutual Funds Research App

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Risk Definition

Institutionalisation And Deinstitutionalisation Of Children 2 Policy And Practice Recommendations For Global National And Local Actors The Lancet Child Adolescent Health

Nudge Marketing From Theory To Practice Cxl

Wealth Management The Impact Of Goal Based Investing

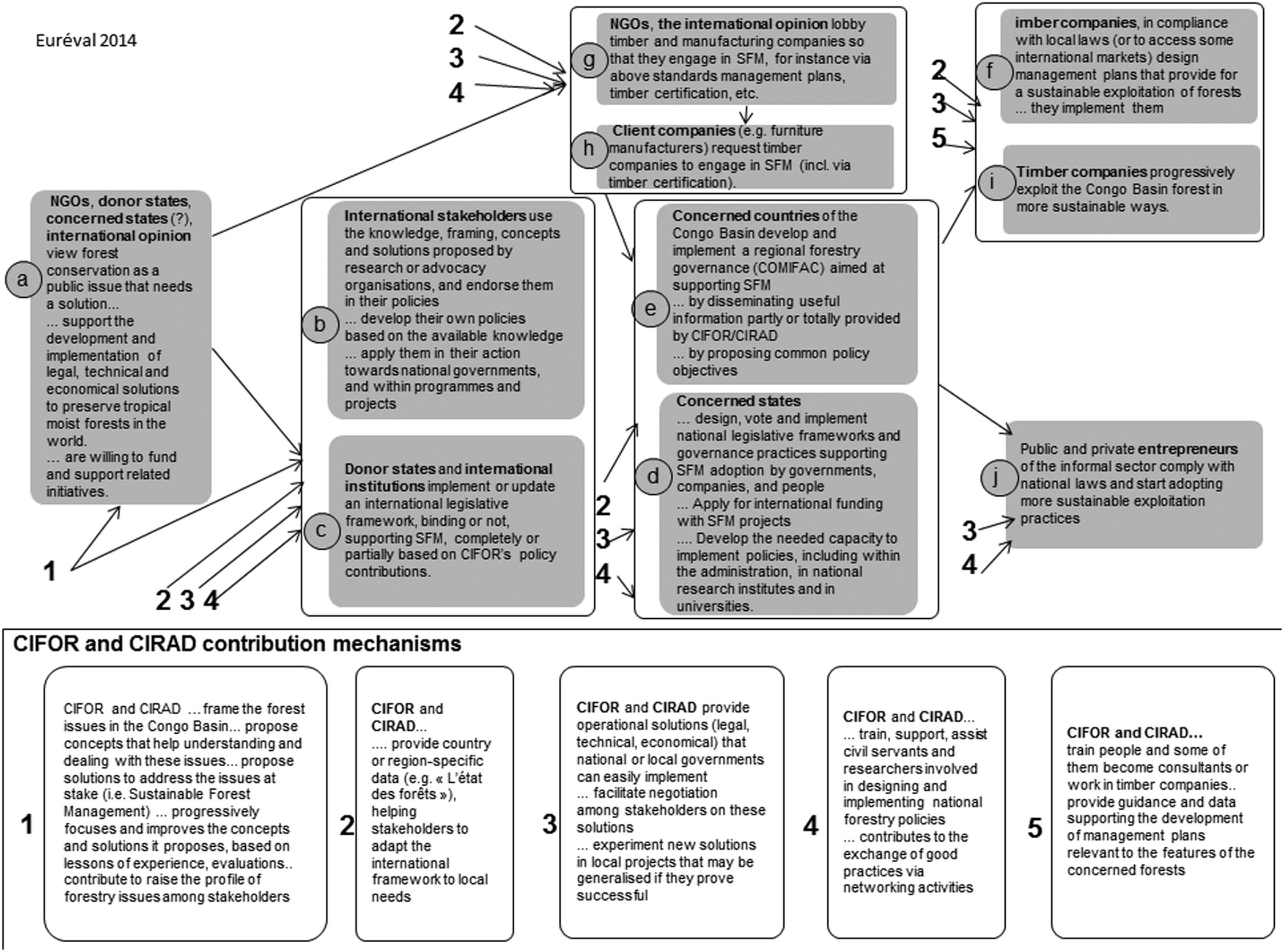

Evaluating Policy Relevant Research Lessons From A Series Of Theory Based Outcomes Assessments Humanities And Social Sciences Communications

Goal Based Investing Gbi Edhec Risk Institute

Goal Based Investing Is The Modern And Correct Way To Personal Wealth Management And Investing Investorpolis

Monitoring And Evaluation For Impact Investing Better Evaluation

Why Practicing Goal Based Investing Is Essential For Small Investors

3

Goals Based Investing The Cnr Way A Fresh Take On An Established Approach

2

Nasp Domains Of Practice

2

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

2

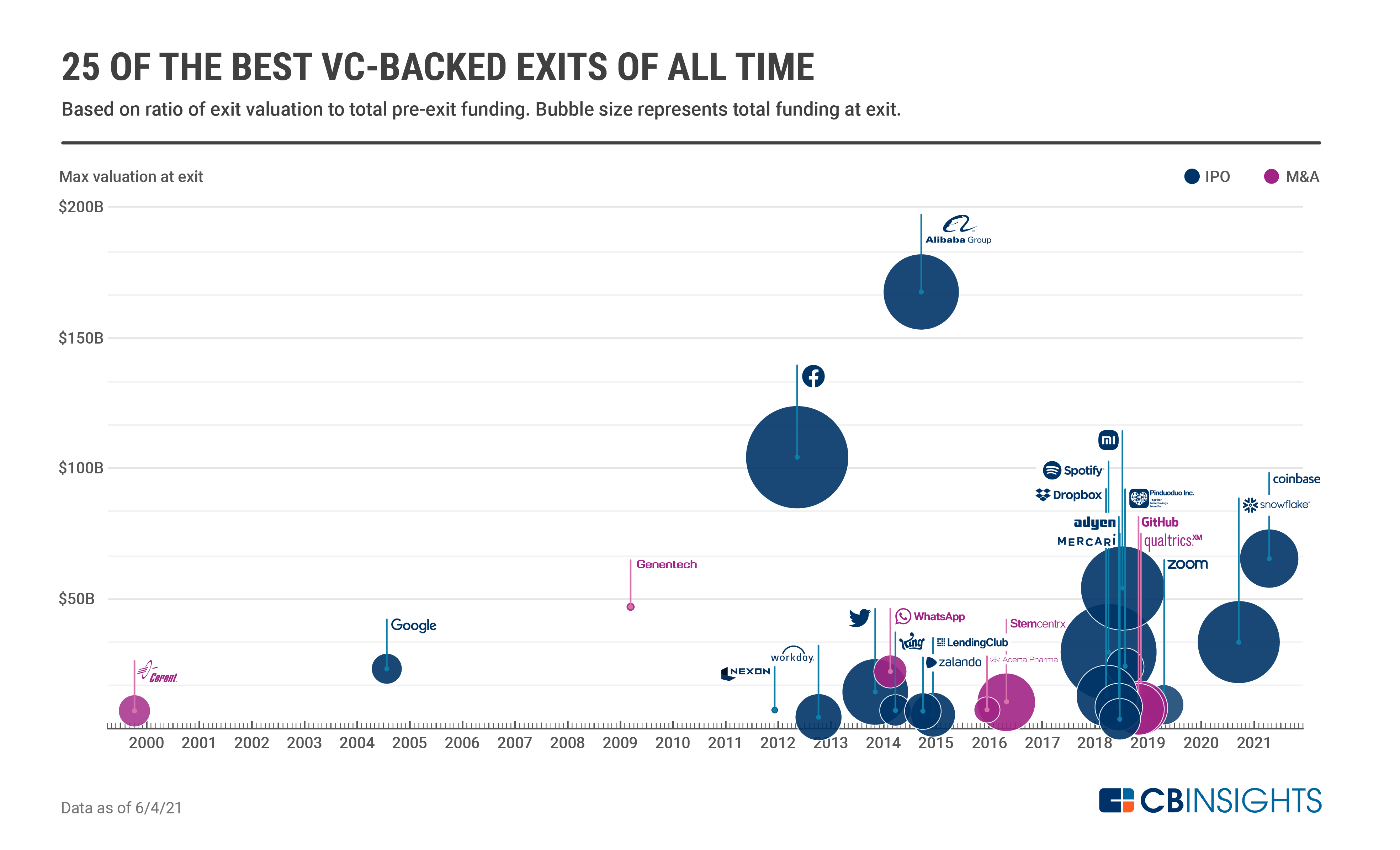

The 45 Best Vc Investments Of All Time What To Learn From Them Cb Insights Research

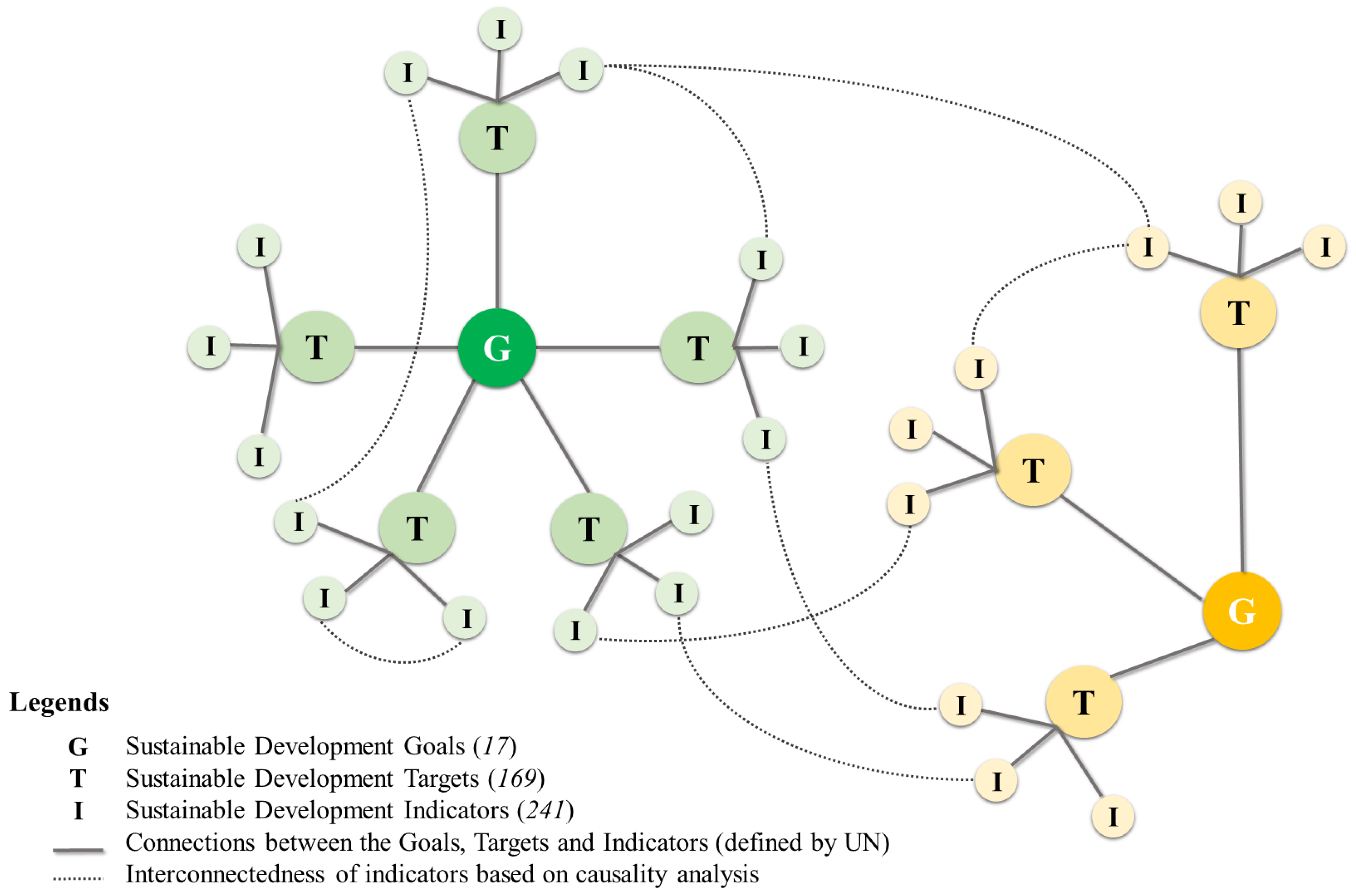

Sustainability Free Full Text Evaluating The Interconnectedness Of The Sustainable Development Goals Based On The Causality Analysis Of Sustainability Indicators Html

Goals Based Investing From Theory To Practice

Learn More About Goal Based Investing Today Iinvest Solutions

:max_bytes(150000):strip_icc()/ellevest-vs-betterment-ebf2bcde1eec4958969a2d2171f2687c.png)

Goal Based Investing Definition

Goals Based Investing Should It Be The Norm Cfa Institute Enterprising Investor

Goal Based Investing Gbi Edhec Risk Institute

The Best Budgeting Apps And Tools For 21 Reviews By Wirecutter

Three Pillars Of Goal Based Investing First Rate

Goal Based Investing The Planning Process In Practice Investorpolis

The Essentials Of Factor Investing

Investment Management Integrated Wealth Management Financial Planner Investment Management Seattle

Why You Re Measuring Investment Risk And Success Wrong Investing 101 Us News

Retiresecure Blog Pension Research Council

Sim Tig Week Driving The Measurement Of Social Investment Towards 30 Integrating The Sdg S Into Impact Investment Monitoring Systems By Debby Nixon Williams Noel Verrinder And Kagiso Zwane Aea365

I Have Heard Of Goal Based Investing What Now Arthgyaan

Goal Based Investing The Planning Process In Practice Investorpolis

Full Article Sustainable Development Goals Sdgs And Pandemic Planning

Monitoring And Evaluation For Impact Investing Better Evaluation

Why You Should Be A Goals Based Investor Cfa Institute Enterprising Investor

Goals Based Investing Suggested As Replacement To Advisers Traditional Approach Ardent Wealth

Goal Based Investing Gbi Edhec Risk Institute

2

Eton Advisors Wealth Management

The Essentials Of Factor Investing

Learn More About Goal Based Investing Today Iinvest Solutions

Harry Markowitz S Modern Portfolio Theory The Efficient Frontier

2

Goal Based Investing Alpha Wealth Advisors Llc

Why Practicing Goal Based Investing Is Essential For Small Investors

Goal Based Investment Planning Retirement Planning Example And Video

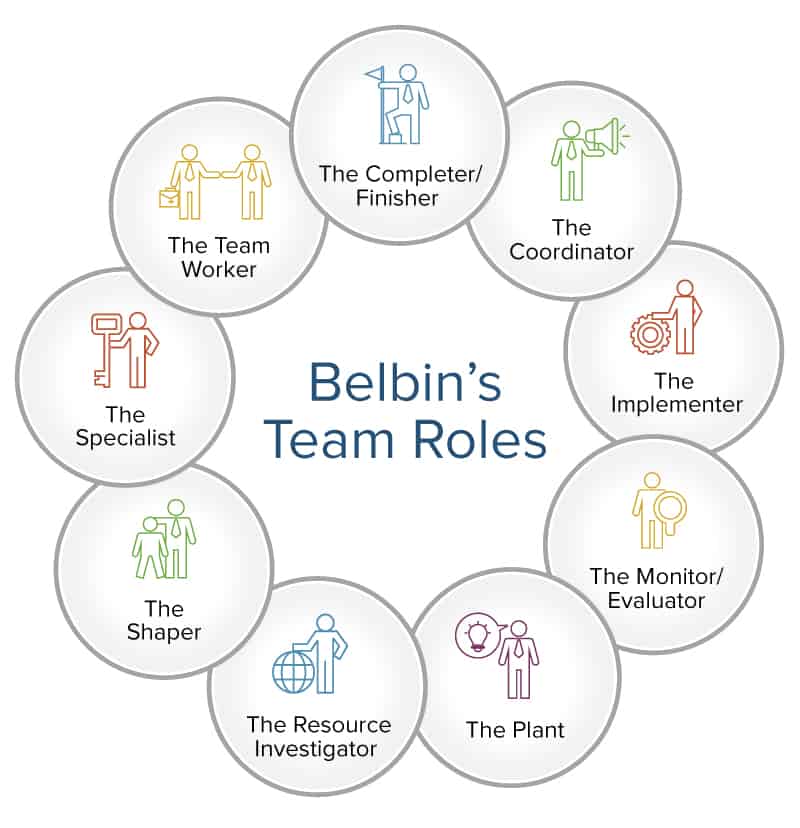

How To Use Team Roles To Boost Performance Smartsheet

Goal Based Investing Wikipedia

Goal Based Investing Theory And Practice Ebook By Romain Deguest Rakuten Kobo United States

Goal Based Investing Alpha Wealth Advisors Llc

Goals Based Investing From Theory To Practice

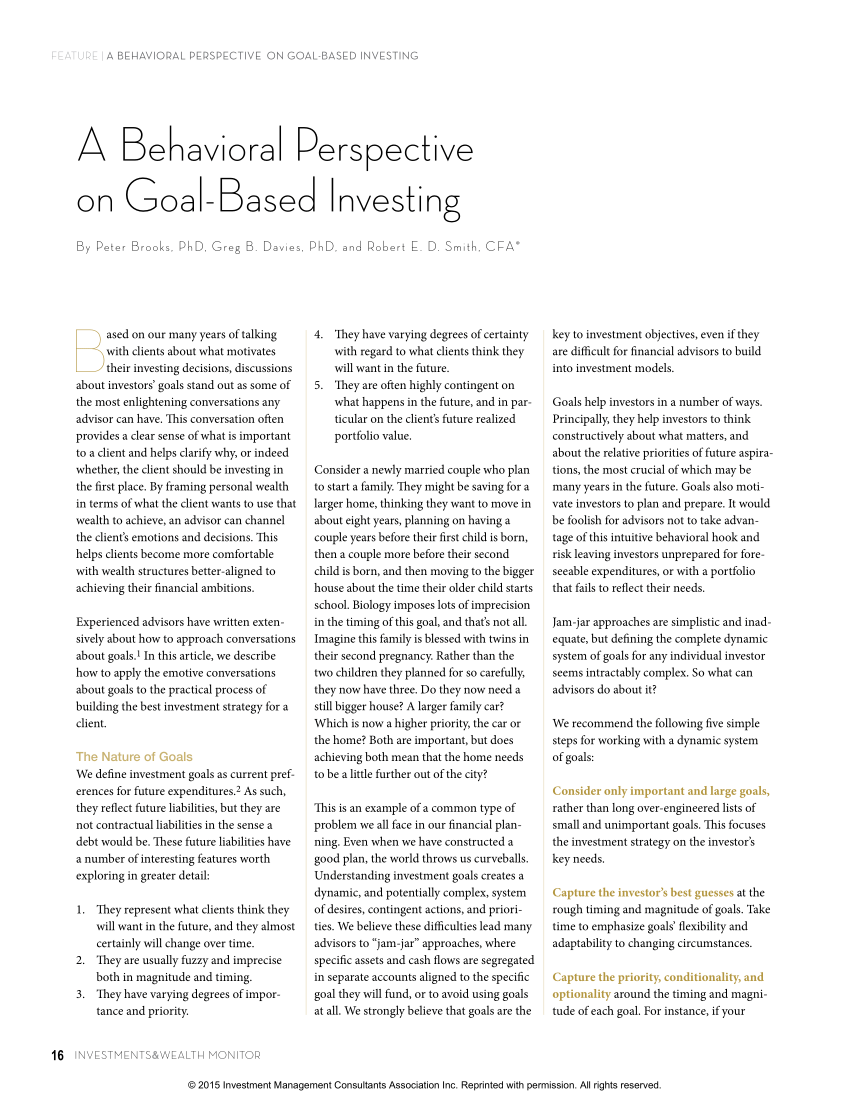

Pdf A Behavioral Perspective On Goal Based Investing

1

What Is Goal Based Financial Planning Anyway Stable Investor

Amazon Com Goal Based Investing Theory And Practice Romain Deguest Lionel Martellini Vincent Milhau Books

7 Human Resource Best Practices A Mini Guide To Hrm

Goal Based Investing Theory And Practice Martellini Lionel Inbunden Adlibris Bokhandel

Investment And Portfolio Management Coursera

2

Goal Based Investment Bm Fiscal Provide Most Innovative And Customized Wealth Management Solutions For Gold Mutual Fund P Investing Investment Advice Goals

1

Goals Based Investing Or Modern Portfolio Theory Diligencevault

The Power Of Goal Based Investing First Republic Bank

Goals Based Investing From Theory To Practice

2

2

Goals Based Investing A Visionary Framework For Wealth Management Davidow Tony Books Amazon Com

0 件のコメント:

コメントを投稿